|

| Why Reconciling Bank Accounts Is Important |

If you do not use accounting software, your financial transactions will appear on your bank account, credit card statements and bank statements. If you use accounting software to print batches of checks each time the company pays bills, your transactions will be recorded in the account register of your software.

WHY YOU SHOULD RECONCILE YOUR ACCOUNTS

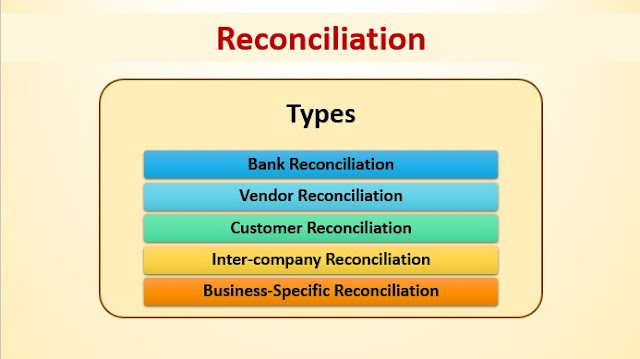

Comparing transactions and balances is important because it helps avoid overdrafts on cash accounts, traps fraudulent or overcharged credit card transactions, explains timing differences, and highlights other negative activities, such as theft or incorrectly recorded income and expense entries. This saves your company from paying overdraft fees, keeps transactions error-free, and helps to catch improper spending and issues such as misappropriation before they get out of control.

The reconciliation of accounts and the comparison of transactions also helps your accountant to produce reliable, accurate and high-quality financial statements. Because your company balance sheet reflects all money spent — whether cash, credit or loans — and all assets purchased with those funds, the accuracy of your balance sheet is strongly dependent on the accurate reconciliation of your company's financial accounts.

Publicly held companies must keep their accounts consistent or risk being penalized by independent auditors. Many companies have systems for maintaining payment receipts, account statements and other data necessary to document and support the reconciliation of accounts.

|

| Why Reconciling Bank Accounts Is Important |

THE RECONCILIATION PROCESS

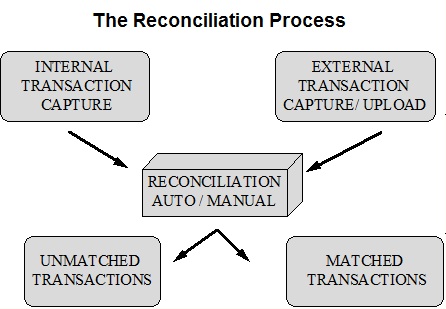

When you use accounting software to reconcile accounts, the software does most of the work for you, saving you a lot of time. However, the process still requires human involvement to capture certain transactions that may never have entered into the accounting system, such as cash stolen from the little cash" box. These five steps are going to help you make sure all your money is being accounted for.- Compare your internal account registry to your bank statement. Go through and check every payment and deposit in your registry that matches your statement. Please note all transactions on your bank statement for which you do not have any other evidence, such as a receipt for payment or a check stub.

- Check that all of the outgoing funds have been reflected in both your internal records and your bank account. Whether it's checks, ATM transactions or other charges, subtract these items from the balance of the bank statement. Note charges on your bank statement that you did not record in your internal records. Charges to be followed include unclear checks, internally recorded auto-payments that have not been cleared from the bank account, check-printing fees, ATM service charges, and other bank charges such as insufficient funds (NSF), overdrafts, or over-the-counter fees.

Check that all incoming funds have been reflected in both your internal records and your bank account: find any deposits and credits that have not yet been recorded by the bank and add them to the balance of the account. If the bank shows deposits that are not reflected in your internal books, make the entries. If you have an interest-bearing account and you reconcile a few weeks after the date of the statement, you may need to add interest as well.

- Check for Bank Errors: Bank Errors do not occur very often, but if they do, the correct amount needs to be added to or removed from your account balance, and you should contact the bank immediately to report the error.

- Make sure the balances are accurate: Your bank statement balance should now equal the balance in your records. Depending on the number of discrepancies, you may need to create a supporting schedule that details the differences between your internal books and bank accounts.

Make sure your balances are accurate: Your balance of bank statements should now be equal to the balance in your records. Depending on the number of inconsistencies, you may need to create a supporting schedule that details the differences between your internal books and bank accounts.

|

| Why Reconciling Bank Accounts Is Important |